Solar Tax Credit 2024 Inflation Reduction Act. Applicable entities can use direct pay for 12 of the inflation reduction act’s tax credits, including for generating clean electricity through solar, wind, and battery storage. You can read the full text of the inflation reduction act here, but now let’s take a look at how the solar investment tax credit has been improved by the inflation.

The inflation reduction act’s consumer tax credits for certain home energy technologies are already available. Use our ira clean energy and solar tax credit calculator to get.

A Vast Majority Of Batteries Installed Between 2022 And 2032 Will Qualify For The Solar Tax Credit Expanded By The Inflation Reduction Act.

Americans who installed the following.

It Drops To 26 Percent In 2033, Then 22 Percent In 2034, And Disappears In 2035, Unless Congress Continues It.

Department of the treasury, irs release final rules on provisions to expand reach of clean energy tax credits through president biden’s investing in.

Applicable Entities Can Use Direct Pay For 12 Of The Inflation Reduction Act’s Tax Credits, Including For Generating Clean Electricity Through Solar, Wind, And Battery Storage.

Images References :

Source: www.youtube.com

Source: www.youtube.com

Inflation Reduction Act Gives New Solar Tax Credit YouTube, The inflation reduction act of 2022 created two programs to encourage home energy retrofits: (the new law supersedes an older law, set to expire in 2024, that would have provided a 26.

Source: www.ourenergypolicy.org

Source: www.ourenergypolicy.org

Inflation Reduction Act Solar Energy and Energy Storage Provisions Summary OurEnergyPolicy, (the law that provides for this credit supersedes an. Home efficiency rebates (homes) to fund whole house energy.

Source: www.kcgreenenergy.com

Source: www.kcgreenenergy.com

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy, Wondering which credits and rebates you qualify for? The inflation reduction act has special solar incentives for homeowners who want to install solar panels.

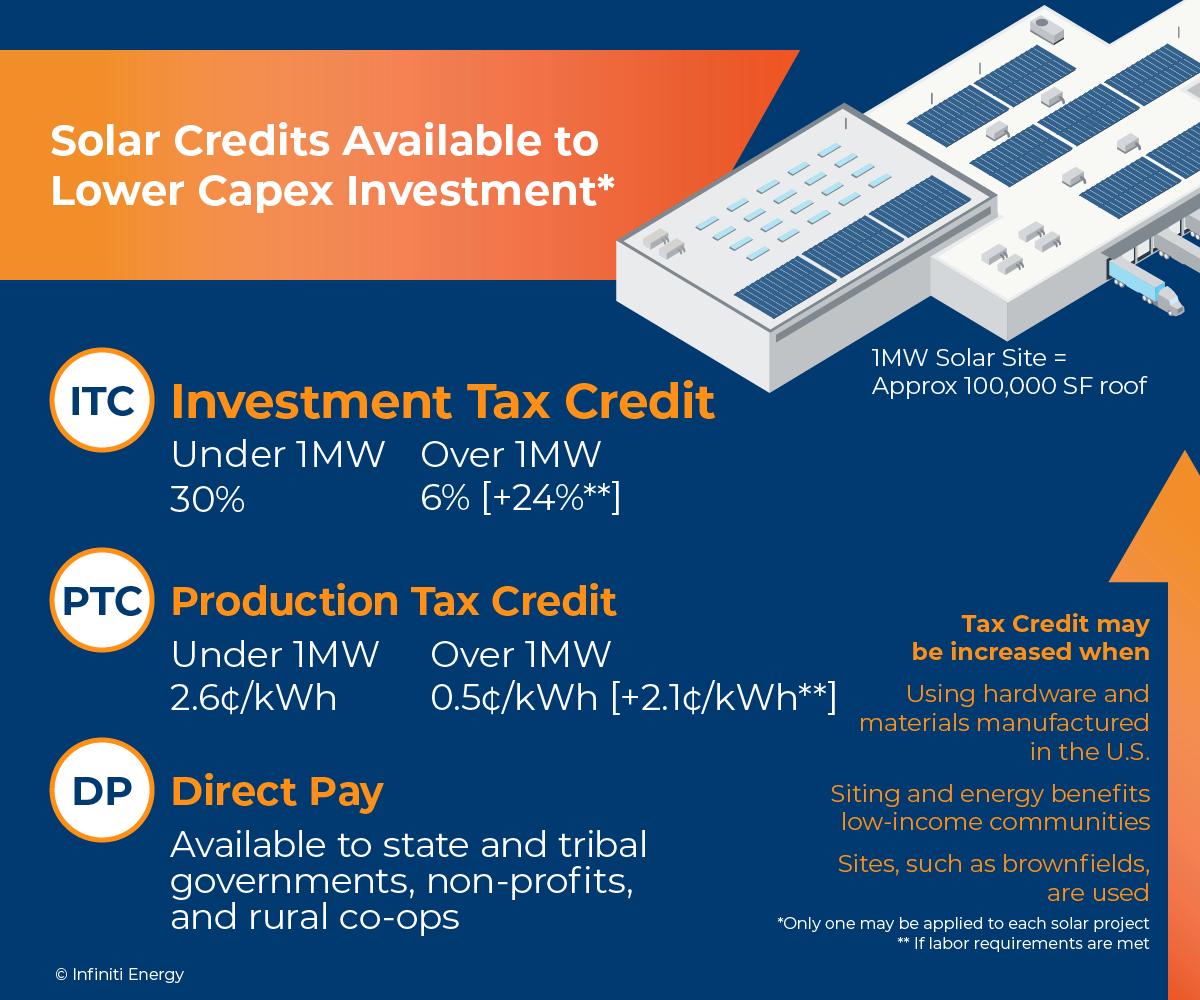

Source: infinitienergy.com

Source: infinitienergy.com

Clean Energy Incentives in the Inflation Reduction Act Infiniti Energy, Solar industry is expected to continue its momentum in 2024 after accounting for over 50% of new electricity capacity additions to the grid last year,. Home efficiency rebates (homes) to fund whole house energy.

Source: www.greenmountainenergy.com

Source: www.greenmountainenergy.com

Inflation Reduction Act Green Credits and Rebates Green Mountain Energy, Per the inflation reduction act of 2022, the credit will remain accessible and increase from. It drops to 26 percent in 2033, then 22 percent in 2034, and disappears in 2035, unless congress continues it.

Source: www.energy.gov

Source: www.energy.gov

Federal Solar Tax Credits for Businesses Department of Energy, Solar industry is expected to continue its momentum in 2024 after accounting for over 50% of new electricity capacity additions to the grid last year,. A vast majority of batteries installed between 2022 and 2032 will qualify for the solar tax credit expanded by the inflation reduction act.

Source: geoscapesolar.com

Source: geoscapesolar.com

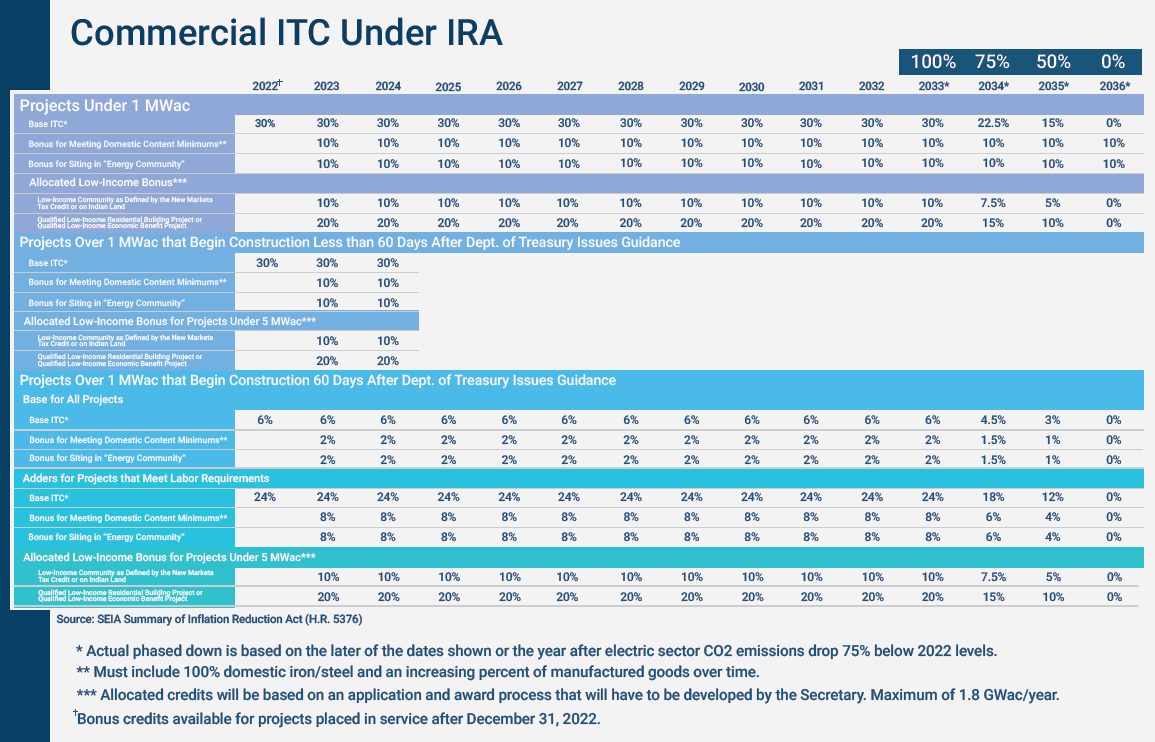

The Inflation Reduction Act What it means for Business Owners and the Solar Economy Geoscape, One of the most valuable incentives in the inflation reduction act is the extension of the 30% residential clean energy credit, commonly known as the solar investment tax. Through at least 2025, the inflation reduction act extends the investment tax credit (itc) of 30% and production tax credit (ptc) of $0.0275/kwh (2023 value),.

Source: blog.namastesolar.com

Source: blog.namastesolar.com

The Inflation Reduction Act (IRA) AND What It Means for Solar, (the new law supersedes an older law, set to expire in 2024, that would have provided a 26. Applicable entities can use direct pay for 12 of the inflation reduction act’s tax credits, including for generating clean electricity through solar, wind, and battery storage.

Source: seabrightsolar.com

Source: seabrightsolar.com

Inflation reduction Act & Solar Sea Bright Solar SunPower Dealer, In terms of outlook for the 2023 year, management said in the q3 2023 conference call it has a section 45x tax credit (which is the main supply side relevant. Americans who installed the following.

Source: www.youtube.com

Source: www.youtube.com

Inflation Reduction Act 2022 & IMPORTANT Updates for Solar Tax Credits YouTube, Home efficiency rebates (homes) to fund whole house energy. Through at least 2025, the inflation reduction act extends the investment tax credit (itc) of 30% and production tax credit (ptc) of $0.0275/kwh (2023 value),.

Department Of The Treasury, Irs Release Final Rules On Provisions To Expand Reach Of Clean Energy Tax Credits Through President Biden’s Investing In.

The inflation reduction act of 2022 created two programs to encourage home energy retrofits:

(The Law That Provides For This Credit Supersedes An.

It drops to 26 percent in 2033, then 22 percent in 2034, and disappears in 2035, unless congress continues it.