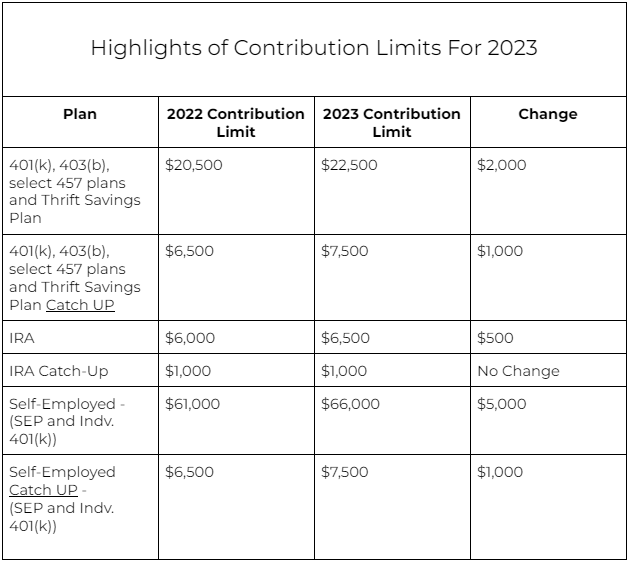

403b Max Contribution 2024 Catch Up Calculator. For 2023, employees could contribute up to $22,500 to a 403 (b) plan. Do you own your own business:

If you exceed this contribution limit, the irs will tax your funds twice. Whether or not you are a business owner may affect how much you can contribute.

403b Max Contribution 2024 Catch Up Calculator Images References :

Source: twilacarolyn.pages.dev

Source: twilacarolyn.pages.dev

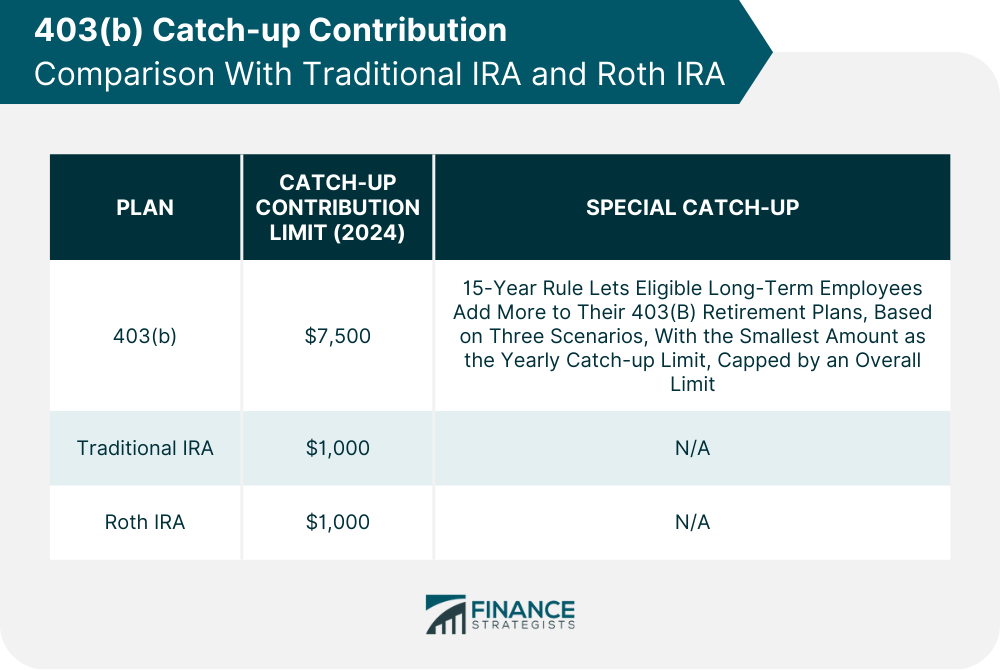

Limit For 403b Contributions 2024 Catch Up Gisele Pearline, I estimate it will go up by $500 to $8,000 in 2025.

Source: daisiblyndsay.pages.dev

Source: daisiblyndsay.pages.dev

Maximum 403b Contribution 2024 Joana Lyndell, If you are over the age of 50, your contribution limit increases to $30,500.

Source: aggyqmaisie.pages.dev

Source: aggyqmaisie.pages.dev

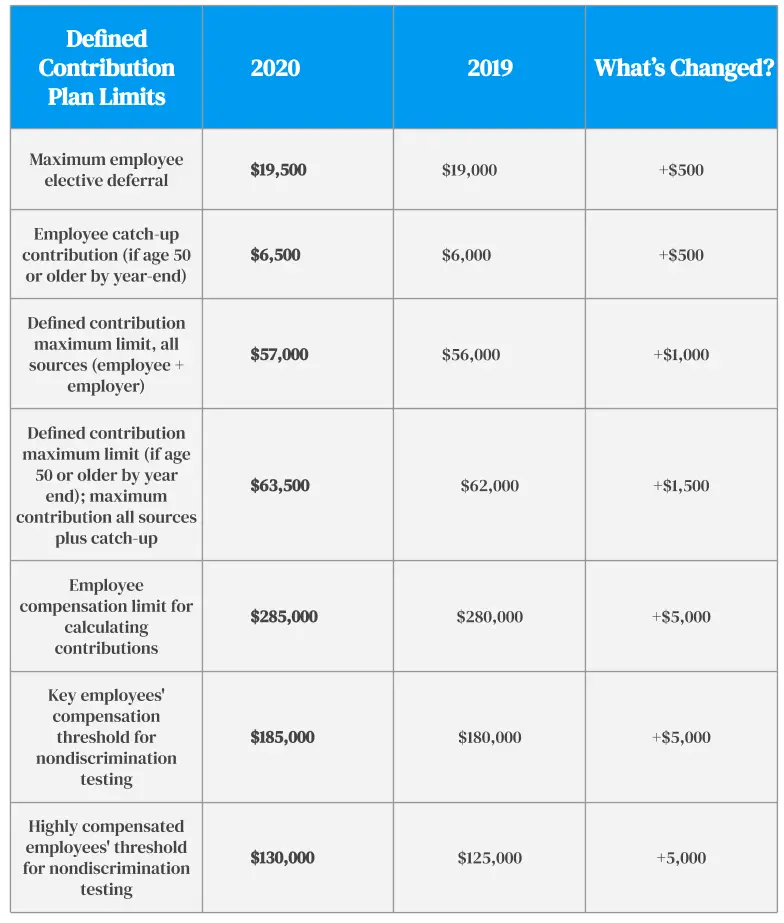

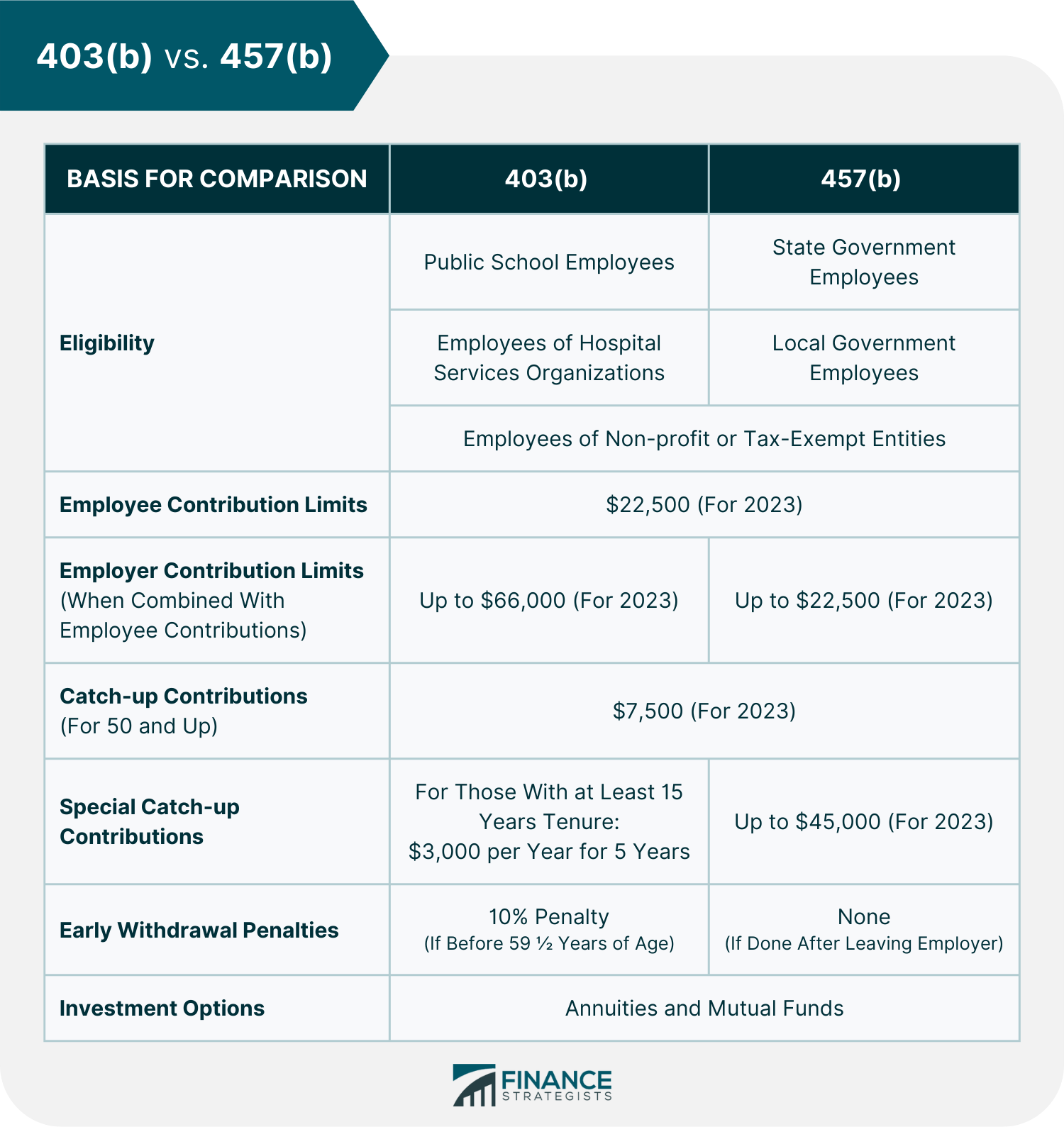

403b And 457 Contribution Limits 2024 Moina Terrijo, This calculator will help you determine your basic salary deferral limit, which, for 2024, is the lesser of $23,000.

Source: cecilbmodestine.pages.dev

Source: cecilbmodestine.pages.dev

2024 Max 403b Contribution Limits Rea Kiersten, I estimate it will go up by $500 to $8,000 in 2025.

Source: nicholasbrown.pages.dev

Source: nicholasbrown.pages.dev

Max 403b Contribution 2024 Catch Up Nicholas Brown, The irs elective contribution limit to a 403 (b) for 2024 starts at $23000.

Source: dedrabevangeline.pages.dev

Source: dedrabevangeline.pages.dev

Max 403b Contribution 2024 Over 50 Tandy Florence, For 2023, the 403(b) max contribution limit is $22,500 for pretax and roth ira contributions.

Source: claretatiania.pages.dev

Source: claretatiania.pages.dev

403 B Max Contribution 2024 Over 65 Chere Deeanne, There is an exception for employees over the age of.

Source: jankaqroxanne.pages.dev

Source: jankaqroxanne.pages.dev

403b Catch Up Contribution Limits 2024 Birgit Fredelia, This calculator will help you determine your basic salary deferral limit, which, for 2024, is the lesser of $23,000.

Source: kariaqlanette.pages.dev

Source: kariaqlanette.pages.dev

What Is The Max 403b Contribution For 2024 Jenny Cristine, I estimate it will go up by $500 to $8,000 in 2025.

Source: jankaqroxanne.pages.dev

Source: jankaqroxanne.pages.dev

403b Catch Up Contribution Limits 2024 Birgit Fredelia, For 2023, employees could contribute up to $22,500 to a 403 (b) plan.

Category: 2024